Written by -

Sonal Sharma

Category -

Finance

Difference between NPV, IRR, MIRR, XIRR and XMIRR

All NPV, IRR, MIRR, XIRR and XMIRR are used to analyze investments and to choose between 2 investments. These measures allow an investor to find out the rate of return he is earning on his investment. NPV is a number and all the others are rate of returns in percentage. IRR is the rate of return at which NPV is zero or actual return of an investment.

Keep readingSat, 08 Mar 2025 0 312

Written by -

Sonal Sharma

Category -

Finance

Difference between Time Weighted Returns and Money Weighted Returns

Money Weighted Returns and Time Weighted Returns can sound a bit confusing. In this blog, we attempt to clarify the difference and uses of these two methods to calculate investment returns.

Keep readingMon, 10 Mar 2025 0 273

Written by -

Sonal Sharma

Category -

Finance

Difference between Non Resident Ordinary (NRO) Account and Non-Resident External (NRE) Account.

Difference between Non-Resident Ordinary (NRO) Account and Non-Resident External (NRE) Account. Which one should an NRI open? Persons with NRI status (Non-Resident Indians) can choose between two options when opening a bank account in India.

Keep readingMon, 10 Mar 2025 0 286

Written by -

Sonal Sharma

Category -

Finance

Tax Equivalent Return Vs. After Tax Return

While evaluating taxable returns vs. tax-free returns, an investor needs to compare the numbers on common platform. The Tax-Equivalent Return formula can help an investor decide if a tax-free investment will give him a better return than a taxable investment.

Keep readingMon, 10 Mar 2025 0 311

Written by -

Sonal Sharma

Category -

Finance

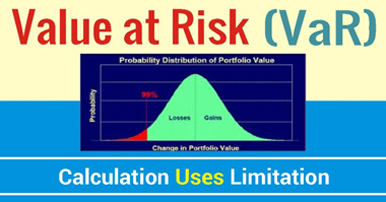

What is Value at Risk?

Learn effective risk management strategies for wealth building, diversification, and financial success. Discover how to adapt to changing economic conditions and achieve long-term goals.

Keep readingMon, 10 Mar 2025 0 176

Written by -

Sonal Sharma

Category -

Finance

Dunbar’s Number and Relationship Capacity of A Wealth Manager

What is supposed to be the ideal capacity of a wealth manager in terms of client relationships? Can technology really help enhance the relationship capacity of an advisor? Is the human brain hardwired to handle only so many human connections? We try to address all of these questions with the help of science-backed ‘Dunbar’s Number’ and ‘Circles of Friendship' which bring a unique perspective to the entire quest. This knowledge might help a wealth manager focus his energy where needed most and achieve the best results possible.

Keep readingTue, 11 Mar 2025 0 221

Written by -

Sonal Sharma

Category -

Finance

8 Behavioral Biases Every Financial Advisor Must Master

Behavioral biases are systematic patterns of deviation from norm or rationality in judgment, which can significantly impact investment decisions. As financial advisors or mutual fund distributors (MFDs), understanding these biases is crucial for guiding clients towards sound investment strategies.

Keep readingWed, 12 Mar 2025 0 202

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Estate Planning

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 285

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 201

Write a public review