Written by -

Amit Kumar

Category -

Financial Planning

DIFFERENCE BETWEEN CAGR, XIRR AND IRR

Returns have always been the central standard while going for any investments. These indicate how much the fund has lost or gained during the particular investment period. You may come across returns expressed in the variety of nomenclatures. Have you ever wondered what does each kind of return signify ? Let's understand....

Keep readingMon, 24 Feb 2025 0 531

Written by -

Sonal Sharma

Category -

Financial Planning

DIFFERENCE BETWEEN CAGR, XIRR AND IRR

Returns have always been the central standard while going for any investments. These indicate how much the fund has lost or gained during the particular investment period. You may come across returns expressed in the variety of nomenclatures. Have you ever wondered what does each kind of return signify ? Let's understand.

Keep readingTue, 04 Mar 2025 0 252

Written by -

Sonal Sharma

Category -

Financial Planning

Chartered Wealth Manager® (CWM®) Vs. Certified Financial Planner®(CFP®)

These two terms Financial Planning and Wealth Management are very confusing and most people generally consider them as synonyms. But actually they are not synonyms. Wealth Management shall mean something wider than financial planning. Wealth management would include not only financial assets but any kind of wealth the advisor is hired for its maintenance, preservation and growing. From our point of view, domestic and international tax Law, corporate Law and Family Law should be considered as a part of the Wealth Management knowledge.

Keep readingWed, 05 Mar 2025 0 490

Written by -

Sonal Sharma

Category -

Financial Planning

RTGS Vs. NEFT Which is a Better Method of Transferring Funds?

The acronym “NEFT” stands for National Electronic Funds Transfer. It is an online system for transferring funds from one financial institution to another within India (usually banks). The system was launched in November 2005, and was set to inherit every bank that was assigned to the SEFT (Special Electronic Funds Transfer System) clearing system.

Keep readingWed, 05 Mar 2025 0 182

Written by -

Rajan Ghotgalkar

Category -

Financial Planning

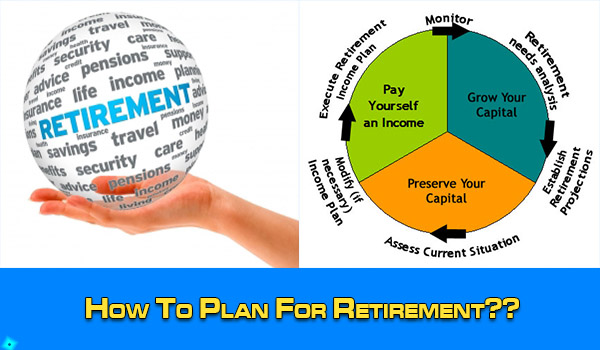

Need for Retirement Planning and the Right Approach

A retirement advisor can guide you to think through your future to identify your goals, quantify them whilst ensuring that, you remain realistic and document them in a SMART manner (Specific, Measurable, Attainable, Realistic, Time-bound). I would expect the advisor to bring in special insights and show you how to extract value for money when buying financial products through the use of tools and techniques by considering the future needs.

Keep readingMon, 10 Mar 2025 0 145

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Financial Statements

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 285

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 201

Write a public review