Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Written by Sonal Sharma - Sat, 15 Mar 2025

Written by Sonal Sharma - Sat, 15 Mar 2025

The Secret Weapon for Indian Investors!

The world of investing is constantly evolving, and Indian investors are increasingly looking for smarter, more efficient ways to grow their wealth. Factor-based passive funds are emerging as a revolutionary investment option, combining the best of passive investing with sophisticated strategies traditionally reserved for active management. In this article, we will explore what factor-based passive funds are, how they work, and why they might be the right choice for your portfolio.

What are Factor-Based Passive Funds?

Understanding the Basics

Factor-based passive funds, also known as smart beta funds, are a type of exchange-traded fund (ETF) or mutual fund that use predefined criteria (factors) to select and weigh securities. Unlike traditional passive funds that track market-capitalization-weighted indexes, these funds aim to capture specific investment factors that can enhance returns or reduce risk.

Common Investment Factors

- Value: Selecting stocks that are undervalued based on financial metrics.

- Momentum: Investing in stocks that have shown an upward price trend.

- Quality: Choosing companies with strong balance sheets and profitability.

- Low Volatility: Focusing on stocks with lower price fluctuations.

- Size: Targeting small-cap stocks with high growth potential.

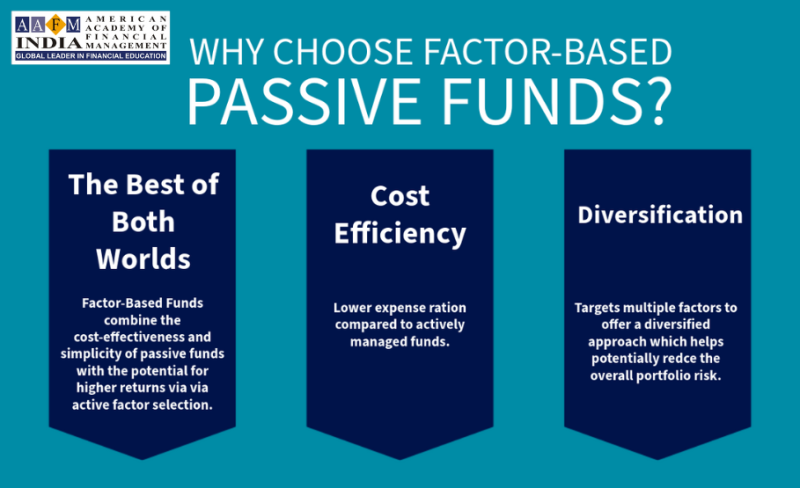

Why Choose Factor-Based Passive Funds?

The Best of Both Worlds

Factor-based passive funds combine the cost-effectiveness and simplicity of passive investing with the potential for higher returns through active factor selection. This makes them an attractive option for investors seeking to optimize their portfolios without incurring high fees associated with traditional active management.

Cost Efficiency

Since these funds follow a systematic, rules-based approach, they typically have lower expense ratios compared to actively managed funds. This cost efficiency can lead to better net returns over the long term.

Diversification

By targeting multiple factors, these funds offer a diversified approach that can reduce portfolio risk. For instance, when one factor underperforms, another might outperform, balancing the overall performance.

How Do Factor-Based Passive Funds Work?

The Investment Process

- Factor Identification: Fund managers identify the factors they believe will drive returns.

- Stock Selection: Securities are selected based on how well they score on these factors.

- Weighting: Unlike traditional funds, which may weight stocks by market cap, factor-based funds weight them based on their factor scores.

- Rebalancing: Periodic rebalancing ensures the portfolio stays aligned with the chosen factors.

Performance Tracking

Performance is measured against custom benchmarks that reflect the targeted factors, rather than a broad market index. This helps investors understand how the fund is performing in relation to its strategy.

Choosing the Right Factor for Your Investment Goals

Aligning Factors with Financial Objectives

Selecting the right factor-based passive fund depends on your specific financial goals and risk tolerance. Here’s a guide to help you choose:

- Long-Term Growth: If your goal is long-term capital appreciation, consider factors like Value and Size. Value stocks are typically undervalued and have potential for price appreciation, while small-cap stocks often offer higher growth potential.

- Stability and Lower Risk: For investors seeking stability and lower risk, Low Volatility and Quality factors are ideal. Low volatility funds focus on stocks with less price fluctuation, and quality funds invest in companies with strong financial health and consistent earnings.

- Short-Term Gains: If you’re looking for short-term gains, the Momentum factor can be advantageous. Momentum funds invest in stocks that have shown an upward price trend, potentially capitalizing on continued growth.

- Income Generation: For those focused on income generation, consider funds that emphasize Dividend Yield. These funds invest in companies with a history of paying high dividends, providing regular income.

Examples

- An investor in their 30s with a long investment horizon might choose a Value or Size factor-based fund to capitalize on long-term growth.

- A retiree looking for stable returns might opt for a Low Volatility or Quality factor fund to ensure consistent performance and lower risk.

Popular Factor-Based Passive Funds in India

Examples of Leading Funds

- Nippon India ETF NV20: Tracks the Nifty 50 Value 20 Index, focusing on value stocks.

- ICICI Prudential Alpha Low Vol 30 ETF: Combines alpha (performance above the benchmark) with low volatility.

- Axis Quality Factor ETF: Targets high-quality stocks with strong fundamentals.

Case Studies

Case Study 1: Nippon India ETF NV20

An investor who chose the Nippon India ETF NV20 in 2015 experienced notable returns, particularly during market downturns when value stocks tended to outperform. This fund's focus on undervalued, financially strong companies helped mitigate losses and provided steady growth over time.

Case Study 2: ICICI Prudential Alpha Low Vol 30 ETF

Investors in the ICICI Prudential Alpha Low Vol 30 ETF benefited from reduced volatility during market turbulence in 2020. The fund's strategy of blending alpha with low volatility stocks provided a smoother ride compared to broader market indexes, showcasing the fund's risk management prowess.

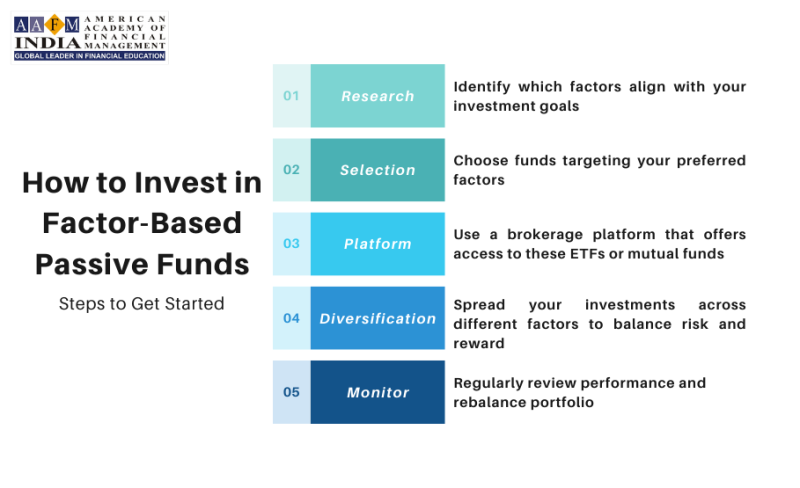

How to Invest in Factor-Based Passive Funds

Steps to Get Started

- Research: Understand the different factors and decide which align with your investment goals.

- Selection: Choose funds that target your preferred factors.

- Platform: Use a brokerage platform that offers access to these ETFs or mutual funds.

- Diversification: Spread your investments across different factors to balance risk and reward.

- Monitor: Regularly review the performance and adjust your portfolio as needed.

Tips for New Investors

- Start Small: Begin with a small investment to understand how the fund behaves.

- Stay Informed: Keep up with market trends and factor performance.

- Consult Professionals: Seek advice from financial advisors if needed.

Comparing Factor-Based Passive Funds with Traditional Index Funds

Key Differences

- Investment Strategy

- Traditional Index Funds: Track market-capitalization-weighted indexes, such as the Nifty 50 or Sensex, investing in proportion to the size of the companies.

- Factor-Based Passive Funds: Use specific factors (like Value, Momentum, Quality) to select and weigh stocks, aiming to capture additional returns or reduce risk.

- Performance Goals

- Traditional Index Funds: Aim to replicate the performance of the market index they track.

- Factor-Based Passive Funds: Seek to outperform the market by targeting stocks with desirable factor characteristics.

- Cost

- Traditional Index Funds: Generally have low expense ratios due to the simplicity of tracking a market index.

- Factor-Based Passive Funds: May have slightly higher expense ratios due to the complexity of factor selection and weighting, but still lower than actively managed funds.

- Risk Management

- Traditional Index Funds: Reflect the market’s overall risk and return profile.

- Factor-Based Passive Funds: Can offer better risk-adjusted returns through diversification across different factors.

Benefits of Factor-Based Passive Funds Over Traditional Index Funds

- Potential for Higher Returns: By targeting specific factors, these funds can potentially outperform traditional index funds.

- Enhanced Diversification: Reducing reliance on market cap and focusing on multiple factors can lower overall portfolio risk.

- Risk Mitigation: Factors like Low Volatility and Quality can help manage risk during market downturns.

When to Choose Traditional Index Funds

- Beginner Investors: Those new to investing might prefer the simplicity of traditional index funds.

- Broad Market Exposure: Investors seeking broad market exposure without the need to understand complex factors.

Pros and Cons of Factor-Based Passive Funds

Pros

- Enhanced Returns: Potential to outperform traditional index funds.

- Risk Management: Better risk-adjusted returns through diversification.

- Cost-Effective: Lower fees compared to active funds.

- Transparency: Clear rules-based approach.

Cons

- Complexity: Requires understanding of different factors.

- Market Timing: Factors can underperform in certain market conditions.

- Tracking Error: May deviate from standard benchmarks.

Conclusion: Are Factor-Based Passive Funds Right for You?

Factor-based passive funds offer a compelling investment strategy for those looking to enhance returns while managing risk. By understanding the different factors and how they work, investors can make informed decisions and potentially achieve better financial outcomes. As with any investment, it’s crucial to do your homework, stay informed, and consider your financial goals and risk tolerance.

In summary, factor-based passive funds represent an innovative approach to investing that blends the advantages of passive management with the strategic insights of active investing. For Indian investors seeking to navigate the complexities of the financial markets with greater precision and efficiency, these funds are worth exploring.

Investing is a journey, and choosing the right vehicle can make all the difference. Factor-based passive funds might just be the smart, modern choice you’ve been looking for to achieve your financial goals. Happy investing

Author by

Comments (0)

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Wills and Trust

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 284

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 201

Write a public review