Dunbar’s Number and Relationship Capacity of A Wealth Manager

Written by Sonal Sharma - Tue, 11 Mar 2025

Written by Sonal Sharma - Tue, 11 Mar 2025

As a wealth manager, have you ever wondered if there is a limit to how many clients you can really manage? If you have heard of Dunbar’s number you would know that the size of the brain in primates has a strong positive correlation with the ideal size of social groups they can manage. Robin Dunbar, a British evolutionary psychologist, did research on this correlation and by extrapolating it to humans he suggested that the ideal group size for humans is around 150.

This is the threshold for stable social relationships one can have, beyond which humans are unable to manage them efficiently. Later studies discovered that this magic number worked well not only in social settings but when it was about deciding the ideal size of highly functional groups such as military units, farming villages and even primitive hunter-gatherer societies in the early stages of civilization.

Human Engagement Vs. Digital Engagement

Now the million dollar question that arises is that if this number indeed has a role in shaping the business world and influences how it works? And if it does, can Dunbar’s Number really put a constraint on the ability of financial advisors and wealth managers to manage a large number of clients? The fact is that despite technology taking up some of the core tasks traditionally performed by human advisors including data collection, analytics and even streamlining investment management, in terms of forging and maintaining healthy client relationships, the element of human connection remains nearly indispensable.

If we take Dunbar’s number to heart and try to understand how it might actually impact a wealth manager's ability to engage with his client base, we will need to differentiate between the idea of human engagement and digital engagement. One can easily engage with hundreds or even thousands of existing and potential clients using email, social media and other modern tools and platforms for communication, but the question is, can it really work as a substitute for the human factor?

To find an answer, imagine a businessman or advisor meeting a new prospect over a coffee to share his proposal and another one who drops a well-crafted email to the prospect explaining his proposal. Now suppose if both are equally professional and persuasive, who stands a better chance of connecting with the client? It goes without saying it is the one who chose to put a human face to his business proposal.

This means we can say confidently that it is the factor of human engagement that holds the key to building and sustaining client relationships more than anything else and it is true that no matter if it an average investor or a HNWI looking for an advisor, most people prefer to stick with someone who is ready to invest time and effort in building a close rapport with the client. It can have several advantages including a chance to better understand the unique needs of a client and offer truly personalized services to show your worth as an advisor.

Human Relationships and Jetson Fallacy

Have you had a chance to watch early-60’s classic animated series “The Jetsons” where people enjoy an extended lifespan in a tech-enabled futuristic world in 2060s? If yes, you can easily relate with the idea of how the human aspect is left completely unchanged in Jetson family 100 years into the future, which has come to be known as the “Jetson Fallacy.” This means that no matter how advanced technology might be the element of human relationships and how they evolve will always remain an exclusive domain unto itself.

Going a step further, though technological enhancement can improve rendering of services but if you think of human caregiving, for instance, you realize it doesn’t increase in efficiency with enhancement in technology and instead remains slow-paced and involves a lot of effort despite all the advances. Finally, it is about the human connection that we are able to establish with our fellow beings which forms an essential part of caregiving as also of any human relationships.

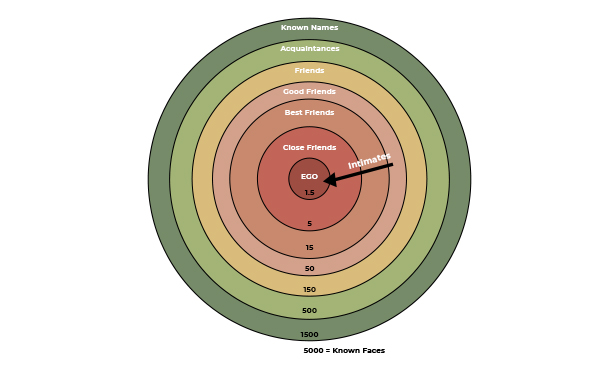

Dunbar’s Circles of Friendship

Robin Dunbar, further elaborating on his original theory, discovered that Dunbar’s number isn’t really a single number but a series of numbers best depicted as a series of concentric circles. They relate to the structure of relationships a person might have, beginning with 1.5 or the most intimate inner circle comprising of romantic relationships followed by the circle of 5, 15, 50, 150, 500, 1500 and 5000 with each circle representing about three times the size of group in the immediate inner circle.

In Dunbar’s own words, “The innermost layer of 1.5 is [the most intimate]; clearly that has to do with your romantic relationships. The next layer of five is your shoulders-to-cry-on friendships. They are the ones who will drop everything to support us when our world falls apart. The 15 layer includes the previous five, and your core social partners. They are our main social companions, so they provide the context for having fun times. They also provide the main circle for exchange of child care. We trust them enough to leave our children with them. The next layer up, at 50, is your big-weekend-barbecue people. And the 150 layer is your weddings and funerals group who would come to your once-in-a-lifetime event.”

Here it’s important to understand that the circle of 150 or any other circle lying outside another circle includes all the people in the inner circles and are not exclusive to each other. For instance, the circle of 5 and 15 form a part and parcel of the core 150 number which means that the clients a financial advisor can really engage with, is effectively less than 150, since the number 150 includes his personal friends and social circle as well.

Dunbar’s Number and Circles for a Wealth Manager

Once you have grasped this idea of concentric circles of friendship, you can interpret it as a wealth manager to classify your clients and business contacts and prioritize your levels of engagement accordingly. Since the first 3 inner circles include your personal and lifelong social circle, let us begin from the outermost circle here. The circle of 5000 can be taken to represent the sum total of your social and professional reach where some level of mutual recognition might be achieved and efforts made to integrate them into the inner circles.

With this 5000, you make your efforts to engage digitally and try to make an impact with some kind of personal interaction by putting a face to your efforts, whether it is in the form of a video or a presentation where you give a fleeting glimpse of your personality along with your business side. The next circle of 1500 could be the number of existing and potential clients you aim to have where you offer something extra to this circle where a number of people might already know you on different levels.

Take up your level of engagement to bring them into the circle of 500 and make it a point to opt for some kind of face-to-face interaction with the circle of 500 over a dinner or a coffee or some kind of social or professional get-together once every quarter or twice in a year. When it comes to the circle of 150, treat them as your best clients and focus on offering the best of human engagement since you want to stick with them in the long-term. This is where you might reap the best rewards possible.

Handpick Your Ideal Clients

The challenge here lies in identifying this core group of 150 clients who could potentially be your best bet in the long-term. It is important to adopt an unhurried approach and be thorough in your client research. The oldest and the best trick in the book is to know your client like no one else does, and not only look for the clients who can offer the kind of growth and stability you are looking for, but for clients whom you can service best and keep happy in the longer run. If you have a good practice, 150-200 might be just around 20% of the total clients whom you intend to serve as a wealth manager.

You need to understand that not all clients are meant to stick with you and put all your efforts into identifying your ideal client based on well-defined criteria. Once you have done that, focus on this core group of clients and make them your first priority when it comes to offering specialized services. Do not be afraid to go above and beyond your standard practice and engage with them both professionally as well as on a personal human level without going over-the-top, which rarely works. Instead, be genuine and honest and choose subtle forms of engagement with a personal touch which tend to work the best.

In the final analysis, though a wealth manager may not be able to grow his/her relationship capacity beyond a certain point, they can certainly use Dunbar’s Number to decide precisely where they need to focus their efforts in terms of human engagement to achieve the best results possible.

If you still have any doubts, let’s put things in a broader perspective. Have you ever wondered why we take so much interest in learning the story behind any big invention or discovery, putting a face to it, or why we are so interested in learning more about our political and business leaders instead of merely focusing on their policies and actions that impact our lives? In the case of the latter it might be considered a way of building trust in our leaders but what about the former, it’s not like we need to know who discovered gravity to be able to feel its effect. Maybe it’s simply the way we are hardwired to connect with others as humans, and Dunbar's Number speaks to that need for human connection alone.

Author by

Comments (0)

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Wills and Trust

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 284

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 200

Write a public review