Discover the Power of a Private Family Trust in India!

Written by Sonal Sharma - Sat, 15 Mar 2025

Written by Sonal Sharma - Sat, 15 Mar 2025

A private family trust is a legal arrangement in which a trustee holds and manages assets on behalf of the beneficiaries of the trust. The assets are transferred to the trust by the grantor, who can also be a trustee or a beneficiary, and the trust is usually established for the benefit of specific individuals or a particular family.

A private family trust can have many purposes, such as:

Wealth Preservation and Asset Protection: A private family trust can provide a way to protect assets from creditors, lawsuits, and estate taxes.

Estate Planning: A private family trust can be used to plan for the distribution of assets after the grantor's death, and to provide for the care of minors, disabled individuals or other beneficiaries who may need assistance managing their affairs.

Business and Tax Planning: A private family trust can be used to hold shares of a family business, and to minimize taxes on business income, capital gains, and other taxes.

Charitable Giving: A private family trust can be used to make charitable donations in a tax-efficient manner.

Special Needs Planning: A private family trust can be used to provide for the needs of a disabled individual while preserving their eligibility for government benefits.

Why Should You Consider Creating A ‘Private Family Trust?’

There are several reasons why an individual may choose to create a private family trust:

Asset protection: A trust can protect assets from creditors, legal claims and other potential risks.

Tax efficiency: Trusts can provide tax benefits, such as avoiding or minimizing estate taxes and income taxes.

Control over assets: A trust allows the individual to maintain control over their assets even after they pass away, by specifying how and when the assets will be distributed to beneficiaries.

Privacy: Trusts can provide a level of privacy, as they do not have to be filed with the court, unlike a will.

Providing for beneficiaries: Trusts can be used to provide for beneficiaries who may be unable to manage assets on their own, such as minors or individuals with special needs.

Continuity of family wealth: Trusts can help preserve and pass on family wealth from one generation to the next.

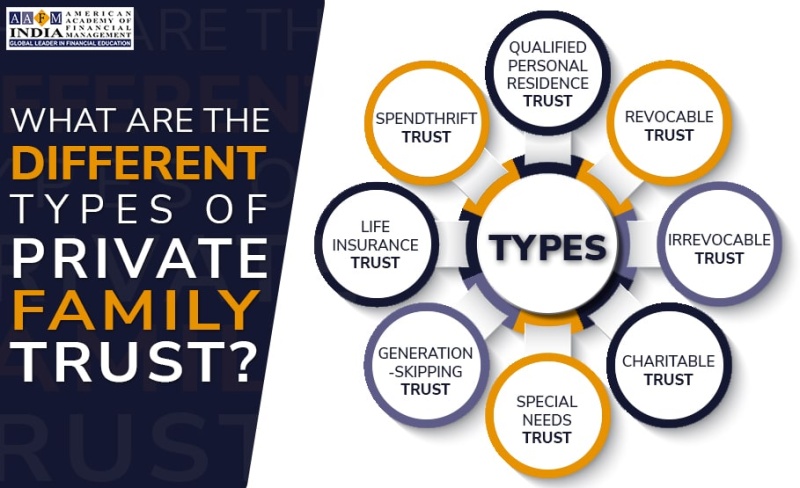

There are several types of private family trusts, including:

Revocable Trust: This type of trust can be modified or revoked by the grantor (the person who creates the trust) at any time.

Irrevocable Trust: This type of trust cannot be modified or revoked by the grantor once it has been established.

Charitable Trust: This type of trust is used to provide support to charitable organizations.

Special Needs Trust: This type of trust is used to provide for the needs of a disabled individual, without affecting their eligibility for government benefits.

Generation-Skipping Trust: This type of trust is used to skip a generation in distributing assets to beneficiaries.

Life Insurance Trust: This type of trust is used to hold and manage a life insurance policy for the benefit of specified beneficiaries.

Spendthrift Trust: This type of trust is designed to protect the beneficiary's inheritance from creditors and from the beneficiary's own poor spending habits.

Qualified Personal Residence Trust (QPRT): This type of trust allow the grantor to continue to live in their residence while they transfer the future appreciation on the residence to the trust beneficiaries.

In India, some popular types of private family trusts include:

Discretionary Trust: A discretionary trust is a trust where the trustee has discretion to decide how and when to distribute the income or assets of the trust to the beneficiaries. It is one of the most popular types of trusts in India as it gives the trustee maximum flexibility in managing the assets of the trust.

Charitable Trust: A charitable trust is a trust that is set up for charitable purposes, such as education, religion, or providing for the poor. Charitable trusts are eligible for tax exemptions under the Indian Income Tax Act.

Specific Purpose Trust: A specific purpose trust is a trust that is set up for a specific purpose, such as building a hospital or setting up a scholarship.

HUF Trust: A Hindu Undivided Family trust is a trust set up by the head of a Hindu Undivided Family (HUF) for the benefit of the members of the HUF.

Will Trust: A will trust is a trust that is created through a will. It comes into effect after the death of the testator and the assets are distributed as per the terms of the will.

Revocable Trust: A revocable trust is a trust that can be altered, amended or terminated by the grantor during their lifetime.

It's important to note that laws and regulations regarding trusts in India can be complex, and it's recommended to consult a lawyer or financial advisor for guidance on setting up a trust that meets your specific needs and goals.

A private family trust is typically established by an attorney and can be revocable or irrevocable. A revocable trust allows the grantor to change the terms of the trust or revoke it entirely, while an irrevocable trust cannot be changed or revoked once it is established. It's important to note that private family trust can be a complex and expensive legal arrangement, it's important to consider all the aspects and seek professional advice before setting it up.

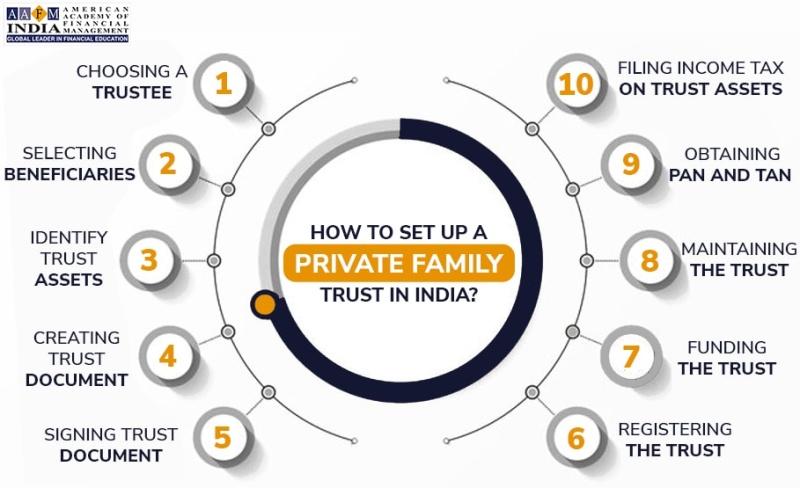

Creating a family trust is a legal process that involves several steps:

Choosing a trustee: The trustee is the person or institution responsible for managing the assets held in the trust. They must be a trustworthy and reliable person, and are usually a family member, friend or a professional trustee like a bank or trust company.

Selecting beneficiaries: Decide who the beneficiaries of the trust will be. These can be family members, friends, or charitable organizations.

Identify the trust's assets: Decide what assets will be transferred into the trust. These can include cash, stocks, real estate, or other valuable assets.

Creating the trust document: Hire an attorney to draft the trust document, which outlines the terms of the trust, including the trustee's duties and the beneficiaries' rights.

Signing the trust document: The grantor, trustee, and any necessary witnesses must sign the trust document.

Registering the trust: The trust deed must be registered with the Registrar of Trusts in the state where the trust is being created.

Funding the trust: The trust must be funded with assets, such as cash, property, or shares. These assets will be used to achieve the purpose of the trust as mentioned in the trust deed.

Maintain the trust: The trustee must keep accurate records, invest in the trust's assets, and make distributions to the beneficiaries according to the trust's terms.

Obtaining PAN and TAN: The trust must obtain a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

Filing Income Tax Returns: The trust is required to file an income tax return every year and pay taxes on the income generated by the trust assets.

It's important to note that Indian Trust Act 1882 governs the creation and operation of trusts in India. It's advisable to consult a lawyer or a chartered accountant to ensure that the trust is set up in compliance with the legal requirements. Creating a family trust can be a complex and expensive process, and it's important to seek professional advice from a lawyer, accountant or a financial advisor before setting it up. Additionally, it's important to review the trust regularly and make any necessary changes to ensure that it continues to meet the needs of the grantor and the beneficiaries.

Choosing a trustee is an important step in creating a family trust. The trustee is the person or institution responsible for managing the assets held in the trust and ensuring that the trust's terms are followed.

Here are some factors to consider when choosing a trustee:

Trustworthiness: The trustee must be a trustworthy and reliable person who will manage the trust assets in the best interest of the beneficiaries.

Experience: The trustee should have experience managing assets and understanding the legal and financial responsibilities of being a trustee.

Availability: The trustee should be available to manage the trust assets on an ongoing basis and be able to make decisions in a timely manner.

Independence: The trustee should be independent from the beneficiaries and the grantor to avoid conflicts of interest.

Professionalism: Consider hiring a professional trustee such as a bank or trust company, if the trust assets are complex or if the trustee is not able to manage the trust assets effectively.

Communication: The trustee should be able to communicate effectively with the beneficiaries and provide them with regular reports on the trust's assets and performance.

It's important to note that choosing a trustee is an important decision and it should be done with care. The trustee must be able to manage the trust assets effectively, follow the trust's terms, and ensure that the beneficiaries' needs are met. It's also important to consider that the trustee can be changed if the need arises, but it's a legal process that can be costly and time-consuming.

A corporate trustee is a legal entity, typically a company, that is appointed to act as a trustee of a trust. The role of a corporate trustee is to manage and administer the assets of the trust, as well as to ensure that the trust is in compliance with legal and regulatory requirements. Corporate trustees can be banks, insurance companies, or other financial institutions that have been approved by the regulator to provide trustee services.

Corporate trustees are usually appointed by the grantor (the person who creates the trust) or by the beneficiaries of the trust. They are typically appointed to provide independent, professional and unbiased administration of the trust. Corporate trustees provide a range of services including trust formation, administration, and asset management.

Corporate trustees are generally considered to be more professional and efficient than individual trustees and are typically better equipped to handle complex and large trusts. They are also considered to be more reliable and stable than individual trustees, as they are less likely to die, become incapacitated, or become unavailable to perform their duties.

It's important to note that, while corporate trustees are subject to regulation and oversight by regulatory bodies, they are also in business to make profit and may charge a fee for their services. And, it's advisable to consult a lawyer or a chartered accountant to select the right trustee for your trust.

Some of the corporate trustees in India include:

HDFC Trustee Company Limited: HDFC Trustee Company is a subsidiary of HDFC Bank and offers a wide range of trustee services including establishment and administration of trusts, and management of assets.

ICICI Prudential Trust Limited: ICICI Prudential Trust is a subsidiary of ICICI Bank and offers services such as trust formation, administration, and asset management.

Kotak Mahindra Trustee Company Limited: Kotak Mahindra Trustee Company is a subsidiary of Kotak Mahindra Bank and offers services such as trust formation, administration, and asset management.

Birla Sun Life Trustee Company Limited: Birla Sun Life Trustee Company is a subsidiary of Aditya Birla Capital Limited and offers services such as trust formation, administration, and asset management.

Axis Trustee Services Limited: Axis Trustee Services is a subsidiary of Axis Bank and offers services such as trust formation, administration, and asset management.

State Bank of India Trustee Company Limited: State Bank of India Trustee Company is a subsidiary of State Bank of India and offers services such as trust formation, administration, and asset management.

UTI Trustee Company Private Limited: UTI Trustee Company is a subsidiary of UTI Mutual Fund and offers services such as trust formation, administration, and asset management.

Please note that this is not an exhaustive list and there are many other corporate trustees in India that provide trust formation and management services. It's advisable to consult a lawyer or a chartered accountant to select the right trustee for your trust.

How Do Corporate Trustees Charge Fees?

The fees charged by corporate trustees in India can vary depending on the services provided and the size and complexity of the trust.

Corporate trustees typically charge an establishment fee, which is a one-time fee charged for setting up the trust. This fee can range from a few thousand rupees to several lakhs, depending on the complexity of the trust and the services provided.

Corporate trustees also charge an annual fee, which is a recurring fee charged for providing ongoing administration and management of the trust. This fee can range from a few thousand rupees to several lakhs per year, depending on the size and complexity of the trust.

Corporate trustees may also charge additional fees for specific services such as investment management, tax compliance, and legal services. These fees can vary widely depending on the services provided and the size of the trust.

Selecting beneficiaries for a trust is an important step in the process of creating a trust. Beneficiaries are the individuals or organizations that will receive the benefits of the trust assets. There can be two parts to this question.

Who Can Be Chosen As A Beneficiary?

Technically speaking, any person capable of holding property maybe chosen as a beneficiary as per Indian Trust Act, 1886. However, it requires careful consideration of who needs and is considered deserving of being the beneficiary of a trust.

Family members: Family members are common beneficiaries of family trusts. It's important to consider the needs and circumstances of each family member when making the decision.

Charitable organizations: Charitable organizations can be beneficiaries of a trust if the grantor wishes to make charitable donations in a tax-efficient manner.

Individuals with special needs: Individuals with special needs may require additional financial assistance and may be named as beneficiaries of a trust to provide for their needs

Factors to Keep In Mind While Choosing A Beneficiary

Here are some factors to consider when selecting beneficiaries:

Purpose of the trust: Consider the purpose of the trust and the needs of the beneficiaries when selecting them.

Age of Proposed Beneficiaries: Consider the age of the beneficiaries when selecting them. Younger beneficiaries may require additional protection and guidance in managing their inheritance.

Relationship Between Trustee and Beneficiary: It's important to consider how the trustee is connected to the beneficiaries, to avoid conflicts of interest.

It's important to note that the trust's terms can be modified over time to reflect the changing needs and circumstances of the beneficiaries. It's also important to consult with a legal professional to ensure that the beneficiaries are selected in accordance with the law and the trust's terms.

How to Create A Trust Document?

Creating a trust document is a legal process that involves several steps:

Hire an attorney: Hire an attorney who specializes in trust and estate law to draft the trust document. This attorney will be able to advise you on the legal requirements of creating a trust in your jurisdiction and ensure that the trust document is legally enforceable.

Define the terms of the trust: The trust document should clearly define the terms of the trust, including the purpose of the trust, the trustee's duties, the beneficiaries' rights, and the distribution of trust assets.

Identify the assets of the trust: The trust document should identify the assets that will be transferred into the trust, such as cash, stocks, real estate, or other valuable assets.

Appoint a trustee: The trust document should appoint a trustee, who is responsible for managing the trust assets and following the trust's terms.

Appoint a successor trustee: The trust document should appoint a successor trustee, who will take over the responsibilities of the trustee in case of their incapacity or death.

Sign the trust document: The grantor, trustee, and any necessary witnesses must sign the trust document.

Register the trust: Depending on the jurisdiction and the type of trust, it might be necessary to register the trust with the appropriate authorities.

Signing a trust document is a crucial step in the process of creating a trust. It signifies the grantor's agreement to the terms of the trust and establishes the trust as a legally binding document.

Here are the steps to sign a trust document:

Review the trust document: The grantor should review the trust document carefully, making sure that all the terms are as expected and that the document is complete.

Obtain notary services: The trust document should be signed in front of a notary public, who will witness the signature and provide notary services to the document.

Sign the document: The grantor should sign the trust document in the presence of the notary.

Additional signatures: Depending on the type of trust, the trustee and any additional parties may also need to sign the trust document.

Keep a copy: The grantor should keep a copy of the signed trust document for their records.

It's important to note that the trust document is a legally binding document, and the signature signifies the grantor's agreement to the terms of the trust. Therefore, it's important to review the document carefully and understand the terms of the trust before signing. Additionally, it's important to keep the original signed document in a safe place, and to provide a copy to the trustee.

Conclusion

A private family trust can be created by anyone with assets to place into the trust. Typically, it is established by individuals who wish to manage and protect their assets for the benefit of their family, including themselves during their lifetime and after their death. It could be anyone who wants to pass on their assets to their beneficiaries in a tax-efficient manner or those who want to protect their assets from creditors and legal claims. A lawyer or financial advisor can assist with the creation of a trust and ensure that it is set up in a way that meets the individual's specific needs and goals.

Author by

Comments (0)

Search

Popular categories

Finance

7Wealth Management

7Financial Planning

6Finance Certifications

4Investing

3Estate Planning

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 285

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 201

Write a public review