`Mutual Funds vs Portfolio Management Services vs AIF

Written by Sonal Sharma - Wed, 12 Mar 2025

Written by Sonal Sharma - Wed, 12 Mar 2025

In the vast landscape of investment options, the choices can sometimes seem overwhelming. As individuals strive to secure their financial future, they often find themselves at a crossroads, unsure of which path to follow. This is where understanding the differences between Mutual funds, Portfolio Management Services, and Alternative Investment Funds (AIFs) becomes crucial. In this article, we will explore these investment avenues in detail, dissecting their unique characteristics and benefits.

Are you eager to make your money work harder for you?

Do you yearn for a deeper understanding of how investments can pave the way towards achieving your financial dreams?

If so, you're in the right place! Throughout this enlightening journey, we will unravel the mysteries behind each investment option and empower you with knowledge to make informed decisions.

Navigating the World of Investments

Investing – a word that holds within it the promise of growth, prosperity, and a brighter future. It is an art that requires knowledge, strategy, and a touch of intuition. As we embark on this journey through the vast realm of investments, we find ourselves standing at a crossroads where choices abound. Mutual Funds, Portfolio Management Services (PMS), and Alternative Investment Funds (AIFs) present themselves as enticing avenues to shape our financial destiny.

But before we dive into the intricacies of these investment options, let us take a moment to appreciate the significance of this juncture. Investing is not just about accumulating wealth; it is about enjoying the journey of wealth creation. In order to enjoy this journey, one needs to choose the right path which will be aligned with the aspiration and psychology of an investor.

Mutual Funds

Investing in Mutual Funds can be a gateway to financial prosperity, allowing individuals to participate in diversified portfolios managed by professionals. With their collective expertise and meticulous research, mutual fund managers aim to maximize returns while minimizing risks for investors. These investment vehicles provide individuals with the opportunity to pool their resources and benefit from economies of scale, even with relatively smaller investments.

Furthermore, mutual funds offer a wide range of options tailored to suit investors' risk appetites and financial goals. Whether one seeks capital appreciation, regular income generation or a balanced approach, there is a suitable mutual fund available. This versatility empowers investors with the freedom to choose an investment avenue that aligns perfectly with their unique aspirations.

Looking at these basic features, one can figure out that Mutual Fund is a product for masses. It is a democratised and granularized product designed for investors from all segments of society and financial strata. Over the years, SEBI and AMFI have digitized the process to a point that today one can buy, sell and hold investments in mutual funds units digitally without dematerializing it.

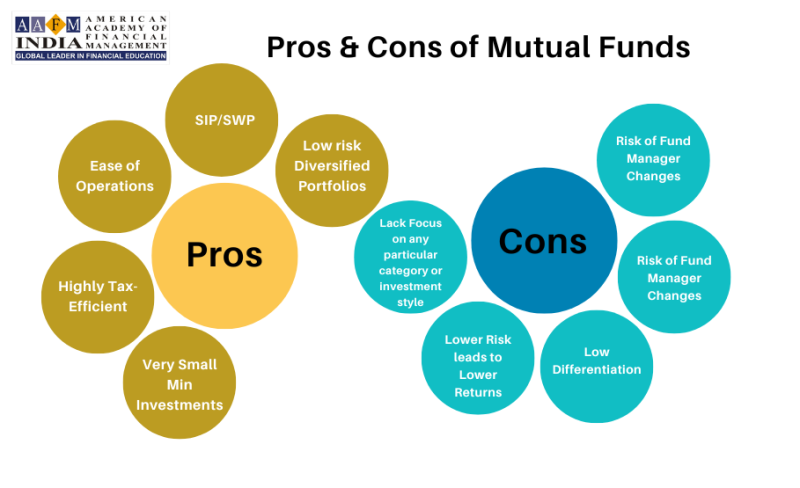

Pros & Cons of Mutual Funds:

Pros:

- Very Small Min Investments

- Highly Tax-Efficient

- Ease of Operations

- Systematic Investment / Transfer / Withdrawal Possible

- Typically, Low risk Diversified Portfolios

Cons:

- Lack of Institutional Focus on any particular category or investment style

- Lower Risk leads to Lower Returns

- Low Differentiation

- Risk of Fund Manager Changes

- Targeted at Retail Customers will lower investment base.

Portfolio Management Services:

Portfolio Management Services (PMS) encompass the management of investment portfolios that include equities, fixed income, cash, debt structured products, and other individual assets. These portfolios are administered by professional money managers who have the capacity to tailor them to specific investment objectives. Unlike mutual funds, where investors hold units of the fund, PMS funds grant ownership of individual securities. This allows for the flexibility to customize the portfolio according to one's unique requirements and objectives. Despite portfolio managers overseeing numerous accounts, each PMS portfolio can be truly unique.

Insight into the Fund: Portfolio Management Service (PMS) is a professional offering that involves certified and experienced portfolio managers, supported by a research team, managing stock portfolios on behalf of clients. This service empowers investors to delegate the management of their portfolios, rather than undertaking it themselves. India boasts a long-established stock market ecosystem, and for decades, investors have engaged in direct equity investments, with many well-known listings since the late 1970s. A significant number of investors maintain equity portfolios in their Demat accounts, managing them based on personal experiences or with the assistance of brokers and equity consultants.

With millions of Demat accounts, certain publicly traded companies have millions of owners. While brokers provide equity research, advisory services, and operational platforms, investors usually bear the responsibility for investment decisions and operational aspects. Conversely, professionally managed portfolios hold the portfolio manager accountable to the investor. Furthermore, these portfolios incur a fee, granting investors access to a comprehensive range of services, including research, investment strategies, and operational execution.

Benefits of Investing in Portfolio Management Services: PMS can be discretionary, where fund managers make investment choices on behalf of investors, or non-discretionary, where fund managers require investor agreement for recommended investments. Another option for professionally managed equity investments is through mutual funds, which also enjoy popularity. Let's explore some of the advantages of PMS:

- Distinguished Portfolio: Individual investors (Non-Promoter Non-Institutional [NPNI]) tend to have a lower proportion of holdings in major indexes like Nifty, BSE 200, or Nifty 500, despite the abundance of listed companies. Non-index smaller firms generally have higher retail or NPNI holdings. In their portfolios, these investors demonstrate a preference for lower-quality equities. Nifty constitutes approximately 60% of the market capitalization, BSE 200 represents nearly 85% of the market capitalization, and Nifty 500 accounts for approximately 94% of the market capitalization.

- The Transparency and Strength of PMS: PMS offers transparency to investors, allowing them to have a detailed account of their portfolio similar to a ball-by-ball report in cricket. Each trade is communicated to the investor, and the manager's website provides a real-time view of the portfolio. For example in Motilal Oswal PMS portfolios, investors can specifically examine a targeted selection of equities in their holdings. This is in contrast to mutual funds, which often have larger portfolios consisting of 25, 30, or even 100 stocks, making it difficult for investors to have full transparency. Mutual funds typically disclose their holdings on a monthly or quarterly basis. Furthermore, investors who hold multiple funds end up with a large number of equities in their portfolios, leading to dilution of returns. By investing in PMS, investors can avoid this issue and have a focused investment approach.

- Focus on Customers: PMS is designed to cater to affluent and wealthy clientele. While mutual funds may target masses, new investors and smaller groups through methods like SIPs, PMS focuses on the rapidly expanding segment of the Indian market that values flexibility and has familiarity with equity investment. The number of individuals investing in stocks is over three times higher than those investing in mutual funds. Additionally, sweat equity has played a significant role in wealth growth in recent years. Investing in PMS allows for easy diversification of assets.

- Online Top Up Convenience: With Motilal Oswal PMS, registering for a SIP is an interesting process due to the relatively low portfolio turnover. When investors register for a PMS-SIP, they have knowledge of the carefully selected high-quality equities that will be purchased month after month. The registration process for a paperless and user-friendly PMS-SIP can be done online. Similarly, investors can add to their PMS portfolio on the same day by purchasing additional amounts online. This is particularly useful during situations like a sudden drop in the Sensex due to global issues unrelated to local markets, as the market tends to recover in a few days.

If an investor meets any of the following criteria, it may be advisable to consider Portfolio Management Services (PMS):

- If the investor possesses a considerable net worth.

- If knowledge of investor about investment and the associated procedures is limited but have experienced the equity market either through your adventures in direct equity or through investments in Mutual Funds.

- If investor lack the time required to constantly monitor and rebalance your investments.

- If investors are not comfortable in handling significant market volatility themselves and would want to delegate, the job to a professional who would be taking care of the methods to safeguard their investments during periods of market uncertainty.

- If investors are interested in diversifying their investment portfolio to benefit from various asset classes such as stocks, debts, equities, etc.

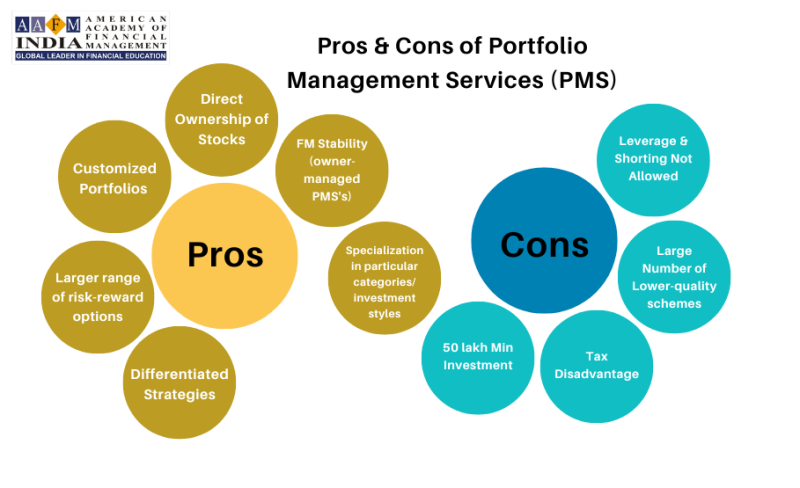

Pros & Cons of Portfolio Management Services (PMS):

Pros:

- Differentiated Strategies

- Larger range of risk-reward options

- Customised Portfolios Possible

- Direct Ownership of Stocks

- FM Stability (owner-managed PMS's)

- Deep specialisation can be created around specific categories/investment styles.

Cons:

- 50 lakh Min Investment

- Tax Disadvantage

- Large Number of Lower-quality schemes

- Leverage & Shorting Not Allowed

Alternative Investment Funds (AIF):

The term "alternative investment fund" refers to a collection of pooled investment funds that invest in venture capital, private equity, hedge funds, managed futures, and other types of investments. It differs from traditional investment options such as stocks, bonds, and debt securities. An Alternative Investment Fund (AIF), as defined by the Securities and Exchange Board of India's Regulation Act, 2012, can take the form of a corporation, a trust, or a Limited Liability Partnership (LLP).

High-net-worth individuals and organizations often participate in Alternative Investment Funds as they require a substantial initial investment, unlike Mutual Funds.

There are different types of Alternative Investment Funds, including those that invest in start-ups, small and medium-sized enterprises (SMEs), and new businesses with strong growth potential. These types of investments have a significant impact on the economy, creating jobs and promoting growth. The government encourages investment in these funds due to their potential economic benefits. They also provide crucial funding for successful firms in need of financial support.

- Venture Capital Fund (VCF) is one type of Alternative Investment Fund. VCFs invest in high-growth start-ups that require capital to develop or expand their operations. They are particularly attractive to new firms and entrepreneurs who struggle to acquire funds through traditional financial markets. VCFs focus on early-stage investments and provide investors with proportional shares in the invested firm.

- Infrastructure Funds (IFs) invest in public assets like road and rail infrastructure, airports, and communication assets. Investors who believe in the future growth of infrastructure can participate in these funds. Infrastructure Fund investors can expect a combination of capital growth and dividend income. Moreover, if the Infrastructure Fund invests in socially acceptable and practical initiatives, the government may offer tax incentives.

- Angel Fund: The Angel Fund is a type of Venture Capital fund where fund managers pool money from multiple "angel" investors to invest in early-stage companies. Investors in this fund receive dividends when these new ventures become profitable. Angel investors, who contribute their business management knowledge, receive units in the Angel Fund. These investors typically choose to invest in companies that don't have the backing of traditional venture capital funds due to the uncertainties associated with such investments.

- Social Venture Fund: The Social Venture Fund (SVF) has emerged as a result of socially responsible investment practices. This fund focuses on investing in companies that prioritize social consciousness and aim to make a positive impact on society. These businesses are driven by the desire to generate profits while simultaneously addressing environmental and social challenges. Despite being a philanthropic investment, investors can still expect a return as these companies generate revenue.

- Private Equity (PE) Fund PE funds invest in privately held companies that are not traded publicly and do not have external stakeholders. Private enterprises that are not authorized to raise funds publicly often turn to PE funds for assistance.

These funds offer their clients a diverse portfolio of shares, which helps to lower the investor's risk. A typical investment horizon for a PE fund ranges from 4 to 7 years. The goal is to exit the investment with a substantial profit after seven years.

Benefits of Investing in AIFs:

When considering investment options, individuals often assess the benefits of AIFs and other funds. Here are some advantages of investing in AIFs:

- Uncorrelated with Stock Market:

Investors who have been involved in the stock market for a long time know that there are ups and downs. The pain of witnessing portfolio value decline, especially for those nearing or in retirement, is all too familiar. One of the main reasons investors turn to alternative investments is to diversify their portfolios.

Private alternatives, like AIFs, have gained popularity as a means to diversify portfolios and provide a hedge against market volatility. In the event of a sharp decline in the stock market, investors will have a protective hedge, and their overall investment portfolio will remain unaffected. Even in a stable economy, the stock market is known for its volatility, while alternative investments are generally more immune to these fluctuations.

- Consider the Importance of Direct Ownership:

In most public investments, what you are essentially acquiring is a paper asset, which represents the future earnings of the investment at a discounted value. However, it's worth noting that you do not actually own any physical possessions. Even when you invest in a Real Estate Investment Trust (REIT), you are still quite far from having your name on the deed of the real estate property.

On the other hand, when you purchase fine wine or artwork, you are directly acquiring the bottles of wine or the oil painting itself. Similarly, when you invest in a rental property, you become the outright owner of that property. If you choose to acquire a mortgage note, you hold a lien on a property.

- Familiarize Yourself with the Tax Benefits:

Alternative investments can potentially offer significant tax advantages. Due to the structure of many alternative investments, you have the opportunity to keep a larger portion of your profits. In many private alternative investments, such as funds or syndicates, the tax benefits are directly passed on to you as a participant.

The two major tax benefits to be aware of are pass-through depreciation and long-term capital gains treatment. Real estate funds or syndications often deduct depreciation expenditure (which is a non-cash expense) from their net income. This deduction lowers the taxable income and can be quite beneficial. Additionally, tax treatment for oil and gas assets, such as depreciation/depletion, offers advantageous tax benefits.

- Recognize the Advantages of Passive Investments:

Many busy investors highly value their time, and actively managing an asset or portfolio requires a significant amount of effort. Let's use real estate as an example, as it is often the starting point for many investors. However, those who become enthusiastic about the idea of renting a single-family house or a small multifamily apartment quickly discover how much effort and steep learning curve is involved. Although there are countless instructors marketing their "5 Step Plan to Success," tasks like recruiting co-investors, securing funding, structuring deals, finding and evaluating properties, and more can be challenging. As a result, many investors give up at this stage and assume there are no further opportunities available.

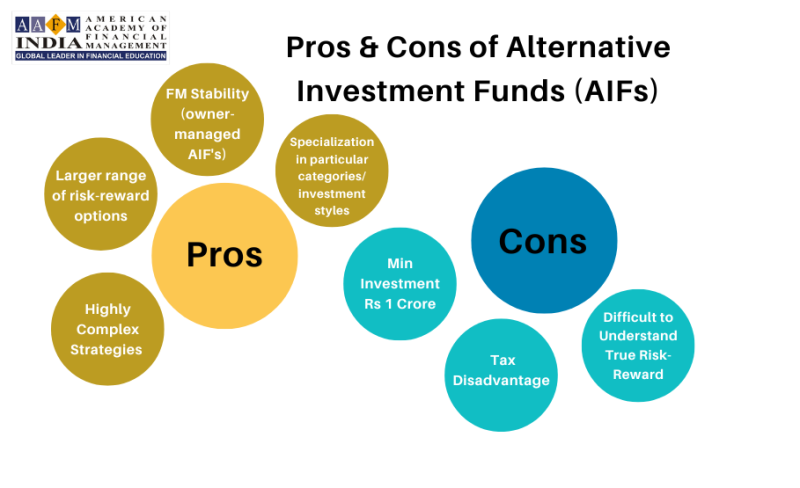

Pros & Cons of Alternative Investment Funds (AIFs):

Pros:

- Highly Complex Strategies Possible

- Larger range of risk-reward options

- FM Stability (owner-managed AIF's)

- Deep specialisation can be created around specific categories/investment styles.

Cons:

- Min Investment of Rs. 1 Crore.

- Tax Disadvantage

- May be Difficult to Understand True Risk-Reward

MF vs PMS vs AIF Comparison Table

|

|

Mutual Fund (MFs) |

Portfolio Management Services (PMS) |

Alternate Investment Funds (AIFs) |

|

Governance / Regulation |

SEBI (Mutual Funds) Regulations 1996 |

SEBI (Portfolio Managers) Regulations 1993 |

SEBI (Alternative Investment Funds) Regulations 2012 |

|

Approach |

Investor money is pooled |

A separate Demat account i.e. a separate portfolio for every client is maintained. |

Investor money is pooled |

|

Types ^ |

MFs are divided into 5 broad categories and 36 sub categories – (i) Equity Schemes (10) (ii) Debt Schemes (15) (iii) Hybrid Schemes (7) (iv) Solution Oriented Schemes (2) (v) Other Schemes (2) |

• Discretionary PMS (the clients funds are managed by the portfolio manager who is responsible for stock selection and executing investment decisions) and • Non-discretionary PMS (consultative investment approach wherein the portfolio manager suggests investment ideas) |

• Category I - Venture capital, Infrastructure, Angel and social venture funds • Category II - Real estate funds, Private equity funds (PE funds), funds for distressed assets • Category III - Hedge funds and private investment in public equity funds. |

|

No of Investors |

There is no cap specified on the number of investors |

The maximum number of investors to any AIF scheme cannot exceed 1,000 |

|

|

Minimum Investment |

Investor can invest in select MFs with as low as Rs. 100 through the SIP mode or a minimum lump sum investment ranges from Rs. 1000 to Rs. 5000. |

The minimum investment size is Rs. 50 lakhs |

All AIFs in India except angel fund require a minimum of Rs. 1 crore investment. |

|

Liquidity |

Lock in Period – Solution Oriented Schemes – 5 years ELSS – 3 years For the remaining no lock in period but exit load applicable. |

Liquidity is relatively lower than that of MF – as investors can withdraw at the discretion in the manner specified in the agreement with exit load applicable in the manner specified therein. |

AIFs are least liquid compared to MF & PMS. Category I & II AIF are closed ended with over 3 years gestation period. Category III AIF may be closed ended or open ended. Usually they are closed ended with applicable exit load after the initial hard lock in period. |

|

Disclosure |

SEBI has directed MFs to share details of risk, performance and portfolio data with the board / investors / distributors / website. |

Required to make timely disclosures to the client. But these are not freely available to the public. Moreover, it is not easy to assess and compare the performance of different PMS products. |

Category I and II AIFs and the Category III AIFs which do not undertake leverage are required to submit report to SEBI on a quarterly basis while Category III AIFs which undertake leverage are required to submit the reports on a monthly basis. Thus, AIFs disclosure requirement are the least stringent as compared to MFs and PMS. |

|

|

Mutual Fund (MFs) |

Portfolio Management Services (PMS) |

Alternate Investment Funds (AIFs) |

|

Income Tax Benefit |

Deduction of Rs. 1.50 lakhs under section 80C under Income Tax Act of 1961 only by investing in ELSS scheme. |

No Tax Benefit |

|

|

Performance |

MFs have to take care of diversification rules, valuation guidelines and redemption related regulations. Therefore, they are benchmark hugging and thus their returns are similar to the benchmark. |

PMS are not regulated in terms of stock / sector concentration limits as in the case of MFs, thus are risker than MFs; however, their returns are much greater for the same reason. |

AIF gives the investor an avenue to pool in funds with the flexibility to invest in derivatives, listed & unlisted equity shares, debt instruments, real estate, hedge fund, etc. Thus, it is riskier than PMS and its returns are greater than that of PMS and MF. |

|

Fees structure |

There is only expense ratio which is adjusted in the NAV of the fund. |

Management fees, and either a fixed fee / performance fee or a combination of both. |

Management fees and either a fixed fee / performance fee or a combination of both with a huddle and a watermark rate. However, their fee structure is more complex than that of PMS. |

|

Process and Documentation |

Both Physical & Online - to buy and sell schemes. |

The investment process is more tedious considering the higher value of transactions. A separate demat account is opened each time a PMS account opened. |

Documentation is lengthy compared to MFs and almost the same as PMS. |

|

Redemption Pressure |

Redemption pressure - will have a negative impact for the investors who stay put in the portfolio as the MF has to honour the redemption. |

The redemption in one investor’s account will not affect other investors as each investor portfolio is held in a different Demat account. |

The magnitude of redemption pressure is lower than that in MFs as there are high exit loads and lock in periods. |

|

Accredited Investment |

Not Applicable |

Applicable - here the minimum investment can be as low as Rs. 25 lakhs to Rs. 50 lakhs |

|

|

Investor Category |

Retail & HNIs (High net-worth individuals) |

HNIs (High net-worth individuals) |

HNIs (High net-worth individuals) & UHNIs (Ultra HNIs) |

Conclusion

While the world of investments may seem complex and overwhelming, understanding the differences between mutual funds, portfolio management services, and AIFs can empower investors to make informed decisions based on their unique financial goals and risk appetite. Whether you are seeking diversification through mutual funds, personalized strategies through portfolio management services, or exploring alternative investment avenues with AIFs, each option offers distinct advantages. By leveraging the expertise of industry professionals and staying attuned to market trends, investors can navigate volatility with confidence and unlock the potential for long-term growth. Embrace the possibilities that these investment avenues present and embark on a journey towards a brighter financial future.

Author by

Comments (0)

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Financial Statements

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 285

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 201

Write a public review