20 Cognitive Biases Every Financial Advisor Must Know

Written by Sonal Sharma - Sat, 15 Mar 2025

Written by Sonal Sharma - Sat, 15 Mar 2025

How These Hidden Biases Are Costing You and Your Clients Big Money?

Cognitive biases can wreak havoc on investment decisions, leading to costly mistakes and missed opportunities. As a financial advisor, understanding these biases isn't just helpful, it's essential. Discover the 20 cognitive biases that could be silently sabotaging your clients' investments and learn how to counteract them for smarter, more effective financial advice.

Cognitive biases are systematic patterns of deviation from norm or rationality in judgment. These biases can significantly impact decision-making processes in investments.

1. Anchoring Bias in Investment Decisions

Definition

Anchoring bias occurs when individuals rely too heavily on the first piece of information they encounter.

Example

In investment decisions, clients might anchor to the initial price of a stock and make subsequent decisions based on this anchor, potentially leading to biased evaluations.

Strategy

Encourage clients to consider the overall market conditions and broader data rather than fixating on initial purchase prices.

2. Availability Heuristic in Financial Planning

Definition

The availability heuristic is the tendency to overestimate the importance of information that is readily available.

Example

Clients might overestimate the risks of investing in the stock market if they frequently hear about market crashes, despite long-term growth trends.

Strategy

Provide balanced information and historical context to help clients make informed decisions.

3. Bandwagon Effect in Stock Market Investments

Definition

The bandwagon effect occurs when the probability of one person adopting a belief increases based on the number of people who hold that belief.

Example

Clients might invest in a popular stock simply because everyone else is doing it, without evaluating its fundamentals.

Strategy

Encourage independent research and critical thinking about investment choices.

4. Blind-Spot Bias in Investment Strategies

Definition

Blind-spot bias is the failure to recognize one’s own cognitive biases.

Example

Clients might criticize others for being overconfident in their investment decisions while failing to see their own overconfidence.

Strategy

Promote self-awareness and regular reflection on investment decisions.

5. Choice-Supportive Bias in Portfolio Management

Definition

Choice-supportive bias is the tendency to remember one’s choices as better than they actually were.

Example

After making an investment, clients might downplay any negative aspects and emphasize the positives, even if there were better options available.

Strategy

Encourage objective assessments and regular reviews of investment performance.

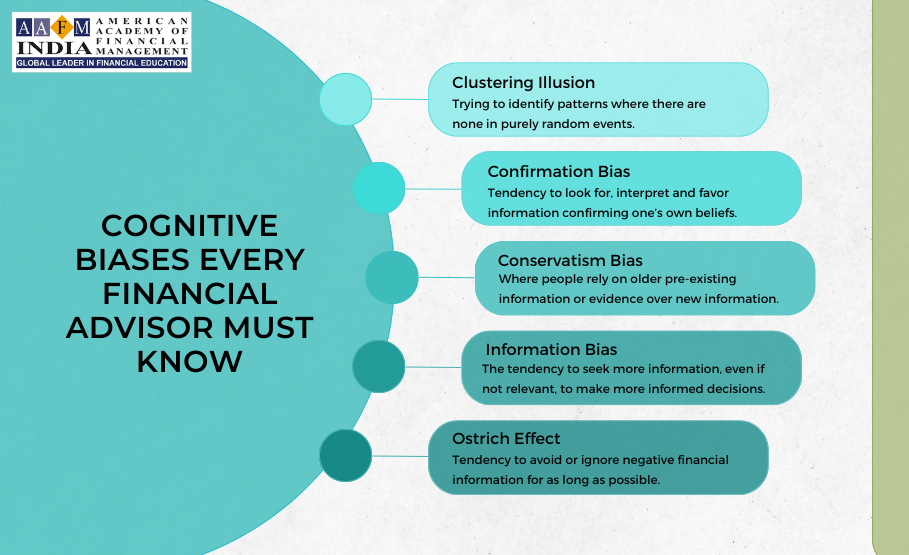

6. Clustering Illusion in Market Analysis

Definition

The clustering illusion is the tendency to see patterns in random events.

Example

Clients might believe that a particular investment will continue to perform well because it has done so in the past, without considering other factors.

Strategy

Provide a broader analysis of market trends and potential risks.

7. Confirmation Bias in Financial Decisions

Definition

Confirmation bias is the tendency to search for, interpret, and remember information that confirms one’s preconceptions.

Example

Clients might only read news articles that confirm their belief in a particular stock, ignoring contrary evidence.

Strategy

Encourage clients to seek out diverse information sources and consider different perspectives.

8. Conservatism Bias in Investment Choices

Definition

Conservatism bias occurs when people favor older evidence over new evidence.

Example

Despite new scientific evidence supporting the benefits of a diversified portfolio, clients might stick to their old, undiversified investment strategies.

Strategy

Present updated research and data to support new investment strategies.

9. Information Bias in Investment Research

Definition

Information bias is the tendency to seek information even when it does not affect action.

Example

Clients might insist on more and more information before making a decision, delaying action unnecessarily.

Strategy

Help clients focus on relevant information and make timely decisions.

10. Ostrich Effect in Market Downturns

Definition

The ostrich effect is the decision to ignore dangerous or negative information by “burying” one’s head in the sand.

Example

An investor might avoid checking their portfolio during market downturns, hoping the problem will go away on its own.

Strategy

Encourage regular portfolio reviews and proactive management.

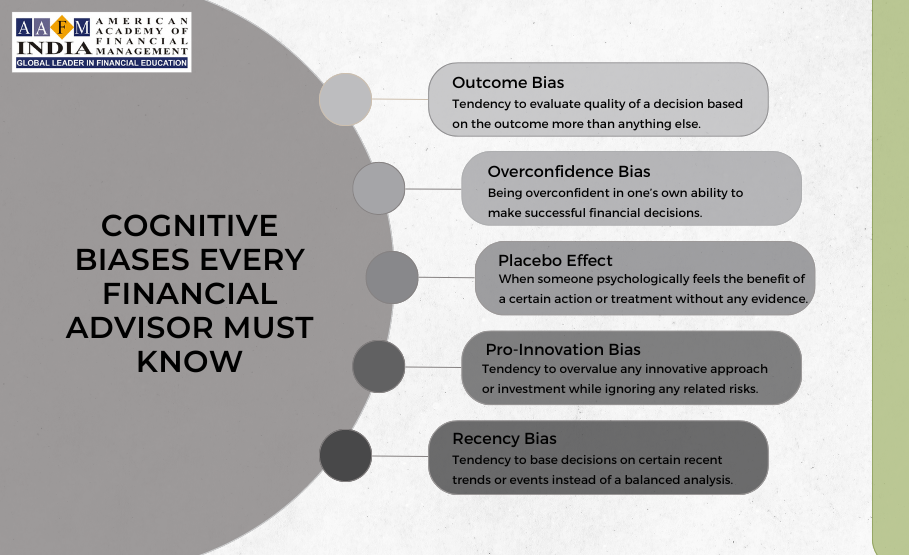

11. Outcome Bias in Investment Performance

Definition

Outcome bias occurs when the quality of a decision is judged based on the outcome rather than the decision process.

Example

If an investment turns out well by chance, clients might think the decision-making process was good, even if it was flawed.

Strategy

Focus on the decision-making process rather than just outcomes.

12. Overconfidence Bias in Stock Picking

Definition

Overconfidence bias is when someone is excessively confident in their own abilities and knowledge.

Example

Clients might overestimate their ability to pick winning stocks, leading to risky investments.

Strategy

Promote humility and continuous learning in investment decisions.

13. Placebo Effect in Financial Products

Definition

The placebo effect occurs when people experience a benefit after the administration of an inactive "look-alike" substance or treatment.

Example

Investors might feel reassured by an investment decision simply because they believe it’s the right choice, without substantial evidence.

Strategy

Encourage evidence-based decision-making.

14. Pro-Innovation Bias in Tech Investments

Definition

Pro-innovation bias is the tendency to overvalue the usefulness of an innovation and undervalue its limitations.

Example

Clients might get excited about a new tech stock, ignoring potential drawbacks and market risks.

Strategy

Provide a balanced view of innovative investments, highlighting both potential and risks.

15. Recency Bias in Market Trends

Definition

Recency bias is the tendency to weigh recent events more heavily than earlier events.

Example

After a market crash, clients might believe another crash is imminent, despite historical recoveries.

Strategy

Use historical data to provide context and mitigate recency bias.

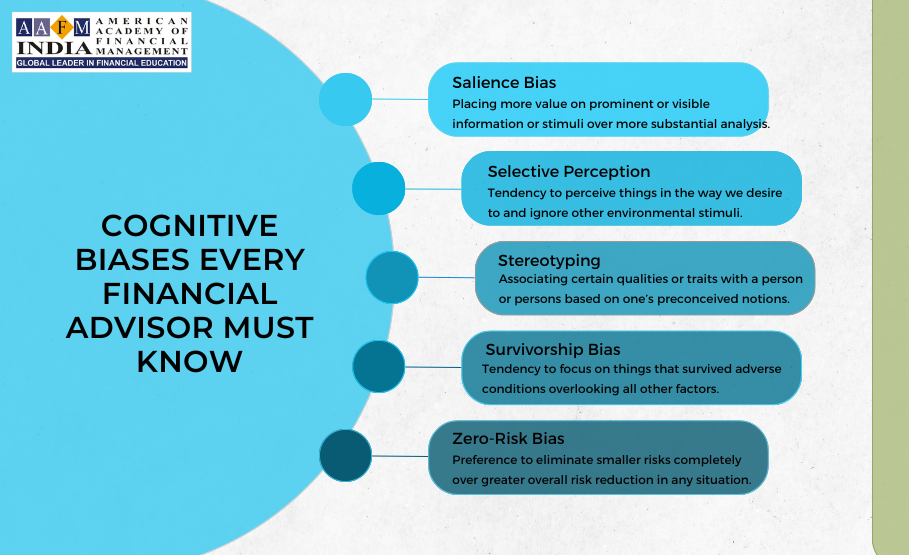

16. Salience Bias in Investment Selection

Definition

Salience bias is the tendency to focus on the most easily recognizable features of a concept or person.

Example

In advertising, brightly colored packaging might draw more attention and influence buying decisions, even if the product itself is not superior.

Strategy

Encourage clients to look beyond the obvious and consider the fundamentals.

17. Selective Perception in Financial Analysis

Definition

Selective perception is allowing our expectations to influence how we perceive the world.

Example

A sports fan might perceive refereeing decisions as unfair if they go against their favorite team, even if the decisions are impartial.

Strategy

Promote objective analysis and diverse viewpoints.

18. Stereotyping in Investment Decisions

Definition

Stereotyping is expecting a group or person to have certain qualities without having real information about them.

Example

Assuming someone is good at math because they are of a certain ethnicity is a stereotype that does not take individual abilities into account.

Strategy

Encourage looking at individuals and investments on their own merits.

19. Survivorship Bias in Market Success Stories

Definition

Survivorship bias is the error of concentrating on the people or things that “survived” some process and overlooking those that did not.

Example

Looking at successful companies and assuming their strategies are the key to success without considering the numerous companies that used the same strategies but failed.

Strategy

Provide a balanced view by discussing both successes and failures.

20. Zero-Risk Bias in Investment Risk Management

Definition

Zero-risk bias is the preference for reducing a small risk to zero over a greater reduction in a larger risk.

Example

People might favor a medical treatment that eliminates a minor health risk entirely over one that significantly reduces a major health risk, simply because it offers the perception of complete safety.

Strategy

Discuss the trade-offs and encourage balanced risk management.

Conclusion

Understanding these cognitive biases in investment decisions is crucial for making better financial choices in both personal and professional contexts. By being aware of these biases, financial advisors can help clients work towards minimizing their impact, leading to more rational and effective decision-making processes. Whether it's in financial planning, investment strategies, or everyday choices, recognizing and addressing cognitive biases can significantly improve outcomes.

Author by

Comments (0)

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Wills and Trust

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 284

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 203

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 200

Write a public review