Active VS Passive Investing: An Epic Battle of Investment Choices

Written by Sonal Sharma - Wed, 12 Mar 2025

Written by Sonal Sharma - Wed, 12 Mar 2025

If you have ever made any market investments, you might have wondered what should be the investment strategy you should adopt. There are no strict rules to follow here and no crystal-clear answers that dictate that a certain investment strategy is better than the others. It all depends on your individual approach, risk tolerance and your investment objectives. Some investors are aggressive in their outlook and prefer to trade and invest aggressively with the intent to outperform the market.

However, experienced investors will testify to it that there is nobody wiser than the market most of the time and any attempts to time the market can often lead to unwarranted levels of risk and losses. On the other hand, some investors are in no hurry to make gains and are in it for the long haul. They are much more patient in their outlook and prefer to buy and hold instead of indulging in short-term trading or aggressive buying and selling.

The choice between these two diametrical opposite approaches to investing has been hotly debated for years. There are a number of opinions and perspectives on the matter but we intend to discuss the very fundamentals underlying these strategies to gain a few useful insights into the subject. We will begin with basic definitions of active and passive investing before trying to compare them and take a look at their pros and cons.

What is Active Investing?

An aggressive strategy where the investor strives to outperform the market is generally known as active investing. It often involves investing in actively managed funds that seek to maximize the returns with a lot of planning and precision. Actively managed funds are driven by the goal to perform better than benchmark index in the short-run. Some examples of active funds include equity, debt and hybrid mutual funds and fund of funds with varying risk levels and investment composition. It offers a great deal of choice to investors with widely differing levels of risk tolerance. There are also some ETFs (Exchange-Traded Funds) with an active style of management.

What is Passive Investing?

This form of investing is not driven by the objective to outdo any market indexes or benchmark funds. It is a relatively laid-back and patient approach to investing where the sole objective is to imitate the performance of any given market index. A typical example of passive funds is ETFs which are managed passively to track the underlying index fund. In these cases, a fund imitates the structure of an index fund with the same composition and makes changes to keep up with the changing composition of the underlying index fund.

Active VS Passive Investing: A Comparison

- Fund Management

Active Investing: Demands Active Management

Active investing requires relatively aggressive fund management and constant re-evaluation of market conditions with a focus on specific funds to choose outperformers. It requires a lot of skill to actively manage a truly diversified portfolio since it involves a careful combination of industry-wide and market-wide analysis along with specialized short-term insights to make appropriate investment decisions.

Passive Investing: Needs Little By Way of Management

By contrast, passive investing does not bother so much about short-term market volatility or with optimizing the portfolio to enhance short-term gains. It is more concerned with matching the performance of a market index by investing in passively-managed ETFs or mutual funds. Passive approach does not require investors to be constantly on their toes and react to every market move. Instead, they can sit back and relax even while markets are in a tizzy.

- Costs

Active Investing: Can Be Really Expensive

Usually, if an active investor is not skilled enough, he/she can choose actively managed mutual funds managed by professional fund managers. This greatly adds to the cost of managing a fund actively, which are typically known to have higher expense ratios. At times, the difference in the outcome of passive and active investing is determined by this element of high cost for active investing. In this sense, it can be kind of self-defeating to pay a huge sum for active management of funds. However, these funds remain quite attractive for institutional investors or High Net-worth Individuals (HNIs) with a higher risk tolerance and can bear such costs.

Passive Investing: Does Not Cost Much

On the other hand, passive investing does not require hiring of fund managers or research analysts to study and manage investments in a bid to enhance returns. This is due to a contended approach which relies on the performance of index funds. As a result, passive investors save a lot more in terms of cost compared to their active counterparts which can make a real difference to their investment returns.

- Goal-Orientation

Active Investing: Intends to Beat the Market

At the very outset, the entire strategy to investing and managing portfolios in directed towards the singular to outperform the market in the near-term. The performance of an investment portfolio or fund is measured against S&P 500 Index, Dow Jones Industrial Average or other benchmark indices to get an idea if they are really doing better than the index itself. One unique advantage afforded by active management is that it helps cut down on the losses during market downturns and earn more than the index when the market is doing well.

Passive Investing: Seeks to Mimic Market Performance

Passive investing has a very different goal as we have already discussed. It is limited to matching the performance of S&P 500 Index and makes little effort to do better than that. It has its own merits and demerits but what it does is simplify the whole thing and saves time and money to be spent in fund management for passive investors.

- Time Horizons

Active Investing: Better Suited for Short-Term Investors

If considered carefully, it emerges as a more successful investing strategy in the short-term. Hence, it is more suitable for investors with a limited time horizon. This can be either due to their instinctive approach as an aggressive investor who likes to make the most of market opportunities without wasting time. Alternatively, it can also be due to the nature of their goals. If an investor is working with a near-term goal, then certainly active investing is the way to go.

Passive Investing: Best for Long-Term Investors

By its very nature, this approach offers certain unique advantages to investors who can buy and hold to achieve much higher returns in the longer run. To make profits in the long-term, investors do not need active management nor do they need to worry about short-term ups and downs in the market. The choice of passive investing can also be influenced by two primary reasons.

First, that someone is a conservative investor by nature and is risk-averse. Minimizing costs can also be a major concern for some investors. Another reason can be that the goals of an investor align with the time horizon in which this investing strategy can deliver results. For instance, it is naturally a better way to invest for someone planning retirement.

- Risk Tolerance

Active Investing: Goes Hand-in-Hand with Higher Risk Tolerance

Actively managing funds entails a higher level of risk, that too especially in the short-term. There is a much higher risk of incurring losses in the short-term, especially with the kind of risky moves involved in active investing. Someone who cannot bear such a level of risk is not advised to choose active investing.

Passive Investing: Best-Fit for Low Risk Tolerance

Investors with relatively low levels of risk tolerance can choose passive investing. There are no sudden investment decisions, no hurry to book profits and no pressure to deliver results quickly. Also, mimicking the performance of market indexes lowers the risk to a large degree since these indices are carefully managed by the market.

Pros and Cons

Active Investing: Pros

Quick Response to Market Conditions

It allows the ability to stay responsive to real-time market movements which can sometimes play a crucial role in dealing with market volatility. Additionally, in steeply falling markets, an active investor can quickly shift his investments to less-risky assets and move deeper into equities in rising markets. This agility can help avoid some major losses and book windfall gains in appropriate market conditions.

Tax-Loss Harvesting

Active investing allows a bit of maneuvering for cutting down on taxes to be paid against trading profits. This is achieved by selling some of the investments at a loss to offset gains made in other trades. As a result, an investor only has to pay taxes on his/her net profit which is derived by subtracting losses from your trade gains.

Build Investing Skills

Yet another possible advantage is that in an effort to manage a higher level of risk, an investor has to constantly learn, strategize and experiment which helps develop their financial acumen. There can be no better training ground for traders and investors to hone their skills. However, this is true only for active investors who manage their own funds which is not often the case.

Active Investing: Cons

Much Higher Costs

As we have already discussed, active investing involves higher fee charged by fund managers and research analysts. It can make a dent in the overall investment gains in the final analysis. It is one of the biggest disadvantages of active investment strategy.

Higher Levels of Risk

Even experts cannot make sure they make all the right moves in a volatile market in the short-term. This is exactly what tends to happen in active investing. Even the biggest of gains can be wiped out with one false move and risk management can become really difficult in the face of market uncertainty.

Requires Top-Notch Trading Skills

It is in fact the flip side of the coin where one side says it will help you build trading skills and deepen market understanding. On the flip side, it says that you need a lot more skills to work with the active approach. The truth is that most people lack such advanced skills and even to develop skills at the cost of real-market risk is not advisable. The end result is that most people are forced to seek professional help which rakes up the costs.

Passive Investing: Pros

Very Low Risk Involved

The single biggest advantage with this approach is that it reduces your risk to a minimum. You need not worry about managing risk and simply track indexes with your choice of ETFs or mutual funds. Zero risk from short-term market volatility.

Does Not Require Lot of Investing Skills

Tracking benchmark funds require not much by way of skills and you need not worry about seeking professional help to manage funds either. It means that investors with almost no skills can also do passive investing for positive returns in the long run.

Fewer Tax Payments

Long-term investing has the inherent advantage of deferring capital gains taxes till you do not sell. It reduces the tax liability a great deal.

Passive Investing: Cons

Not Equipped to Deal with Sudden Market Movements

Unlike active approach, passive investors do not have the advantage of responding to sudden market movements and any steep fall in the index their funds are tracking will reflect in their investments. Although it may not affect them due to longer time horizon but if they need higher liquidity or are nearing an important goal like retirement then it could pose a real challenge.

No Sudden Gains and Little Maneuvering

Passive investing nearly rules out the possibility of enjoying any sudden windfall gains since they work with a highly diversified portfolio in an attempt to track benchmark indices. It also means there is little space to maneuver or to do any kind of counterbalancing in case the index takes a beating.

SPIVA Scorecard to the Rescue

The million dollar question or should we say the billion dollar question in this ongoing debate about active vs passive investing is where do facts stand. Unless we are able to quantify our assertions, they might qualify as nothing more than opinions. To overcome this challenge, we will take help of the SPIVA (S&P Indices Versus Active) scorecard published by S&P Dow Jones Indices. It seeks to measure relative performance of actively managed funds and their benchmark index counterparts across global regions. The scorecard itself is based on an in-depth analysis of available market data using advanced research metrics.

To ensure there is no inconsistency or bias in the analytical approach adopted by SPIVA, they rely on these fundamental principles which helps keep them on the right track. Let’s first take a brief look at these criteria before discussing their findings.

Survivorship Bias Correction

It ensures that all of the active funds at the beginning of a study period are taken into account and not just the ones that survive till the end. This offers a more objective and complete view of how active funds have performed over time.

Apples-to-Apples Comparison

Actively managed funds are only compared to benchmarks that match their size and classification and not just any benchmarks to avoid a lopsided view of things.

Asset-Weighted Returns

It considers weighted average returns for any fund in a given period based on its net assets for a more transparent view.

Style Consistency

This metric seeks to measure if a fund stayed true to its categories of investments or diverged and how it impacted its performance.

SPIVA Scorecard Key Findings

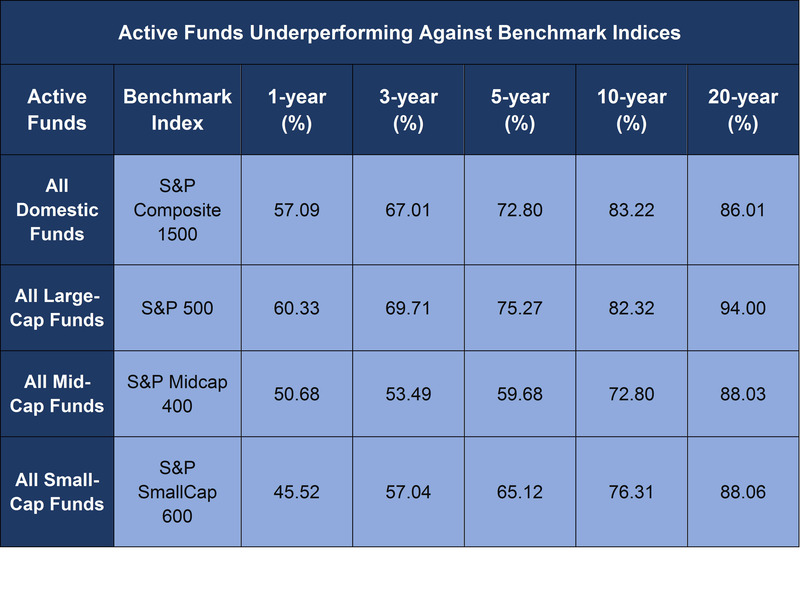

Some of the key findings in SPIVA Scorecard reveal that in the short-term several actively managed US funds outperformed index funds but not consistently. However, in medium and long-term, active funds increasingly underperformed index funds and that too in a consistent manner across fund categories.

Active Funds Underperforming Against Benchmark Index

You can find by what percentages US funds underperformed comparable indexes for different time periods.

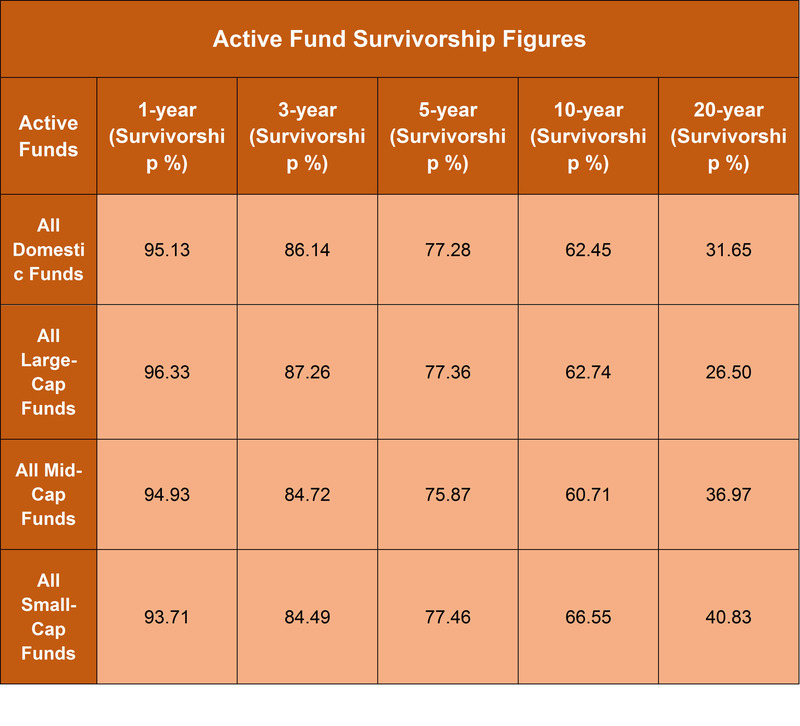

How Many Active Funds Survived?

Survivorship among active funds also declined across most categories with advancing time horizons and by the end of 20-year period, only 26.50% of All Large-Cap Funds had survived and rest were either merged or liquidated. You can find fund survivorship figures in the table below.

Key Takeaways

In terms of comparison, passive investing clearly emerges as a far better strategy on almost all counts. Active investing has limited advantages and its biggest downside is the kind of risk it carries. A single short-sighted move is enough to wreak havoc with the returns on investment and the investor may not have enough time to recover losses as well. On the other hand, passive investing offers greater stability and consistent results on the whole.

SPIVA Scorecard nearly settles the debate once and for all by emphasizing with facts and figures how active funds continue to underperform benchmark indices in the long-term. Here are the key takeaways based on what we have discussed so far.

Active Investing

- Needs expert fund management to beat the markets

- Costs can take a toll on returns of the fund

- Considerably higher level of risk

- Offers some great opportunities to gain from rising markets

- Most suitable for short-term aggressive investors with higher risk tolerance

- Tend to underperform benchmark indices in the long-term

Passive Investing

- Requires very little management

- Low cost of managing funds

- Minimal level of risk

- Offers stable returns

- No sudden gains or growth opportunities

- Offers stable returns and consistently better fund performance compared to actively managed funds in long-term

- Best fit for the profile of risk-averse conservative investors with a long-term horizon

Can You Combine the Two Approaches?

It is not like these two styles of investing are like monoliths and cannot be brought together to manage portfolios better. As a matter of fact, there are a number of investors who also prefer to have the best of both worlds by combining these two approaches to maximize the returns without compromising on the ability to meet long-term goals. This is achieved by managing two separate portfolios with both active and passive holdings to allow greater freedom in investment choices.

An actively managed portfolio can be a great way to hedge against passive investment portfolio when its underlying benchmark index is performing poorly. However, it also requires a lot of planning to achieve a combination strategy which can be very effective to experience both growth and stable returns over a long period of time.

Final Verdict

Ultimately, the choice between passive and active investing is a bit like choosing whether to bide your time or take the leap right away when it comes to managing your investments. Based on their individual level of risk tolerance, time horizon and other relevant factors, investors can go along with the investing approach or strategy which can be of help to meet their goals in an effective manner. It also becomes clear that personality traits of an investor are just as important in choosing an investment strategy as their individual goals. It might be said that the key to successful investing lies in taking a personalized view of your investments to find the most appropriate strategy that is compatible with your investment goals and needs as well as your personality.

FAQs

- Active funds are managed in a way to

- Track an index fund

- Beat an index fund

- Beat returns of ETFs

- Track ETFs

- Passive funds are targeted to

- Track overall market growth

- Track a specific market index

- Track growth of mutual funds

- Beat mutual fund returns

- Active funds have

- Higher risk tolerance & low costs

- Higher risk tolerance & high costs

- Lower risk tolerance & high costs

- Lower risk tolerance & low costs

- Passive funds have

- Higher risk tolerance & low costs

- Higher risk tolerance & high costs

- Lower risk tolerance & high costs

- Lower risk tolerance & low costs

- Sudden market movements directly impact performance of

- Active funds

- Passive funds

- Over increasing periods of time

- Active funds outperform market indices

- Active funds underperform market indices

- Active fund performance equals the performance of market indices

- Passive funds are typically known for

- Low level of risk & little fund management

- High level of risk & little fund management

- Low level of risk and active fund management

- High level of risk and active fund management

- Is it possible to combine active and passive investing strategies?

- Yes

- No

- Passive funds are managed in a way to

- Respond to short-term market movements & trends

- Respond to long-term market movements & trends

- None of the above

- Passive fund require

- Advanced investing skills

- No investing skills

Author by

Comments (0)

Search

Popular categories

Wealth Management

7Finance

7Financial Planning

6Finance Certifications

4Investing

3Estate Planning

2Latest blogs

Discover the Power of a Private Family Trust in India!

Sat, 15 Mar 2025 0 284

9 Surprising Things You Should Never Include in Your Will (And What to Do Instead)

Sat, 15 Mar 2025 0 204

Why Indian Investors Are Flocking to Factor-Based Passive Funds?

Sat, 15 Mar 2025 0 200

Write a public review